Which of the brand key metrics is the most important to measure?

This is one of the most common questions asked when tracking brand efforts. Often, the client has concluded that it must be awareness or preference. But saying that awareness or preference is the most optimal key metric is like claiming that socks or a scarf are the most optimal garments. Of course, you want at least a basic set, and you should adapt your clothing to the weather.

When the French organization Union des marques (UDM) set out to structure brand methodology, they ended up with a list of over 400 brand key metrics, which, after prioritization, became a list of 87 key metrics in 3 categories. A year later, the Effect Committee (Sveriges Annonsörer) presented a reduced list of 36 key metrics in 6 categories. Despite this, the question did not become easier – measuring brand effects is complex.

Visualize your brand journey

A better analogy than clothing is to think of brand key metrics as components in a car, where the Brand Funnel is a car whose task is to take your target audience from where they are now to where you want them to be. For the car to move forward, you need a body (awareness), four wheels (consideration), and a steering wheel (preference or trust). These are the central key metrics you should measure to understand how well your brand engine is working.

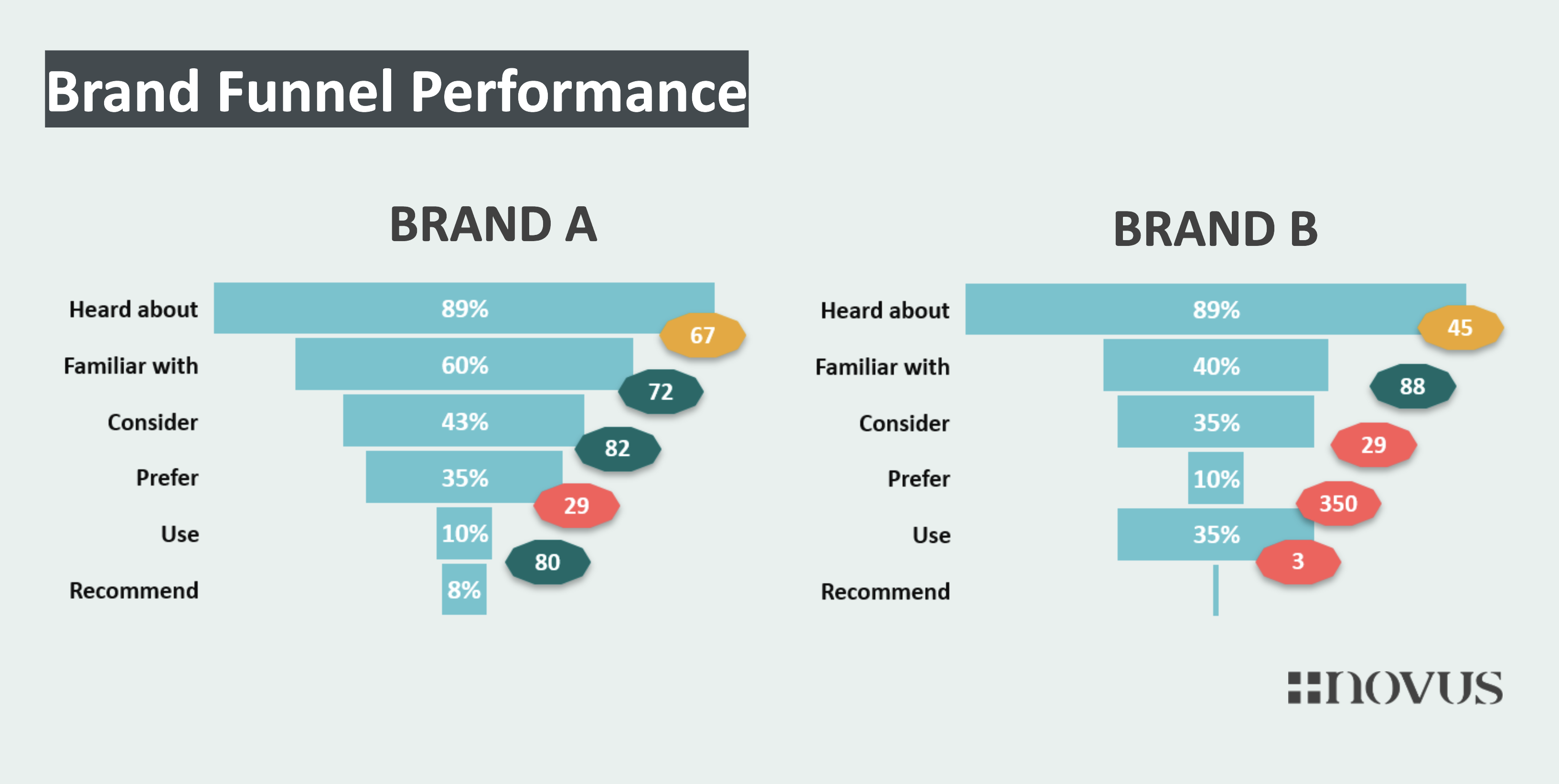

The Brand Funnel framework is a mental model you can use to map the mental journey people go through before deciding to buy your product or service. Below, we have two commonly recurring examples from our analyses.

Brand A has successfully created a whole where each step in the mental journey works in balance. This means that many people are aware of the brand, a large portion of these individuals develop a preference for the brand, and ultimately, a high percentage become actual customers who drive sales for the company by recommending it.

The scenario for Brand B is common among startups or businesses that prioritize sales-driving efforts over long-term brand building. The company has a larger share of customers than consumers with strong brand preference. This indicates that they successfully attract a specific target audience, but brand loyalty is low, and the risk of these customers switching to competitors when given the chance is high.

Is any step not working as it should? Then it’s time for a more comprehensive troubleshooting. High consideration that does not lead to brand preference? It usually means that brand preference goes to a stronger competitor! High brand preference that does not lead to new customers? The market likes you but possibly does not see the value in your product. It might be time to review the company’s value proposition.

Why is it like that…

Our human brain is complex. It comes with built-in filters that ensure very little communication manages to get through all the way. The brain asks us questions like – do I know this, can I consider it, would I choose it over others? Imagine you need to sell a product to three people. The first has never heard of your company or product. The second has heard of the product and likes it. But the third knows the product, likes it, and has previously considered trying it. Who is the easiest to sell to?

Of course, you benefit from talking to the third person. She knows the product and has already been considering buying it. The sales effect becomes much greater. Therefore, it has been realized that it is good to be one step ahead and start preparing the target audience so that sales can be as effective as possible later on. It’s about working away the brain filters they might have and creating conditions that tactical sales communication, such as advertising, is poor at. We must first build awareness, interest, and liking BEFORE we start talking about purchase.

By aggregating this mindset at the market level, you get a valuable overview of which brand efforts need to be prioritized next and within which target audience segments to focus on.

What does your brand journey look like? The Brand Funnel analysis is included in our basic surveys.

Contact us at Novus to learn more .

Ieva Englund

Client Development Advisor, Novus